How To Invest On The Ghana Stock Exchange

The Ghana Stock Exchange (GSE) represents a unique opportunity for Ghanaian investors to participate in the growth of the country’s economy. As Ghana’s primary stock market, the GSE provides access to publicly traded companies across various sectors including banking, telecommunications, mining, and consumer goods. Investing on the GSE allows you to become a partial owner in these companies and potentially benefit from their success through capital appreciation and dividends.

Whether you’re a complete beginner or have some investment experience, understanding the fundamentals of stock market investing is crucial before you start. This comprehensive guide will walk you through everything you need to know to begin your investment journey on the Ghana Stock Exchange.

What is a Stock and Why Invest?

A stock represents ownership in a company. When you buy shares of a company listed on the GSE, you become a shareholder and own a small portion of that business. This ownership comes with certain rights and potential benefits.

[!NOTE] Central Securities Depository (CSD): Unlike the old days of paper certificates, shares on the GSE are held electronically in a CSD account. This ensures your holdings are secure and easily transferable.

Shareholder Rights

As a shareholder, you have several important rights:

- Voting Rights: Vote on major company decisions like electing board members and approving mergers

- Dividend Rights: Receive portions of company profits when declared (not guaranteed)

- Information Rights: Access to financial reports, company announcements, and shareholder meetings

Potential Benefits

Investing in stocks offers several ways to potentially build wealth:

- Capital Appreciation: Buy shares at a lower price and sell higher as the company grows

- Dividend Income: Regular cash payments from company profits

- Total Return: Combination of price gains and dividends

- Inflation Protection: Stocks historically outpace inflation over time

Taxation on Returns

It’s important to understand the tax implications of your investments:

- Dividends: Subject to an 8% withholding tax, which is deducted at the source.

- Capital Gains: Currently, capital gains on listed securities are exempt from tax to encourage investment on the exchange.

Opening Your First Brokerage Account

Before you can invest on the GSE, you’ll need to open a brokerage account with a licensed stockbroker. The Securities & Exchange Commission (SEC) regulates all stockbrokers in Ghana to ensure investor protection.

Choosing a Stockbroker

Several reputable brokers operate in Ghana, including:

- IC Securities: Popular platfrom with a convenient mobile app

- BlackStar group: modern platform with mobile apps for ease and convenience.

- SIC Brokerage

Find the full list of registered brokers on the GSE website.

Consider factors like commission rates (typically 1.5-2.5% per transaction), minimum investment requirements, trading platforms, and customer service when selecting a broker.

Required Documentation

To open an account, you’ll need:

- Valid Ghanaian ID (Ghana Card, Passport, or Driver’s License)

- Bank account details or mobile money number for fund transfers

- Optional documentation may include proof of address (utility bill or bank statement) and Tax Identification Number (TIN)

The account opening process typically takes 2-9 business days.

Funding Your Account

You can fund your brokerage account through:

- Bank transfers (most common method)

- Mobile money (MTN/Telecel/Airteltigo)

- Cheque deposits

- Cash deposits at broker offices

Funds are usually available for trading within 24 hours.

Understanding Stock Trading Basics

Trading Hours

The Ghana Stock Exchange is open for trading from 10:00 AM to 3:00 PM GMT, Monday through Friday (excluding public holidays).

Stock Orders

- Market Orders: Execute immediately at the current market price

- Limit Orders: Allow you to specify the maximum price you’ll pay

Reading Stock Quotes

When researching stocks, pay attention to:

- Current price and daily change

- Trading volume (higher volume = more liquidity)

- 52-week price range

- Market capitalization (company size)

[!TIP] GSE Composite Index (GSE-CI): Keep an eye on this index. It tracks the general performance of the entire market, helping you gauge if the overall market is trending up or down.

Placing Your First Trade

Once your account is funded, you’re ready to make your first investment. You don’t need millions to start; you can begin with as little as GHS 50 or GHS 100, as many stocks trade for just a few cedis per share. Start small and focus on learning the process.

Step-by-Step Trading Process

- Research the company thoroughly

- Check current market price and bid/ask spread

- Decide on position size (start with 2-5% of your portfolio)

- Choose order type (limit order recommended)

- Enter quantity and price

- Review and confirm the order

- Monitor execution and keep records

Common Mistakes to Avoid

- Trading without research

- Using market orders on illiquid stocks

- Buying too much too fast

- Not setting stop-loss orders

- Making emotional decisions

Understanding Investment Risk

All investments carry risk, and understanding different types of risk is essential for successful investing.

Types of Risk

- Market Risk: Affects all investments (economic downturns, interest rate changes)

- Company-Specific Risk: Unique to individual companies (can be reduced through diversification)

- Volatility Risk: Price fluctuations

- Liquidity Risk: Difficulty selling shares quickly

- Inflation Risk: Loss of purchasing power

Building a Diversified Portfolio

Diversification is key to managing risk. Don’t put all your money in one stock or sector.

Portfolio Building Strategies

- Dollar-Cost Averaging: Invest fixed amounts regularly to reduce timing risk

- Position Sizing: Limit each investment to 2-5% of your portfolio initially

- Sector Diversification: Spread investments across different industries

- Regular Rebalancing: Adjust your portfolio periodically to maintain target allocations

Educational Platforms & Resources

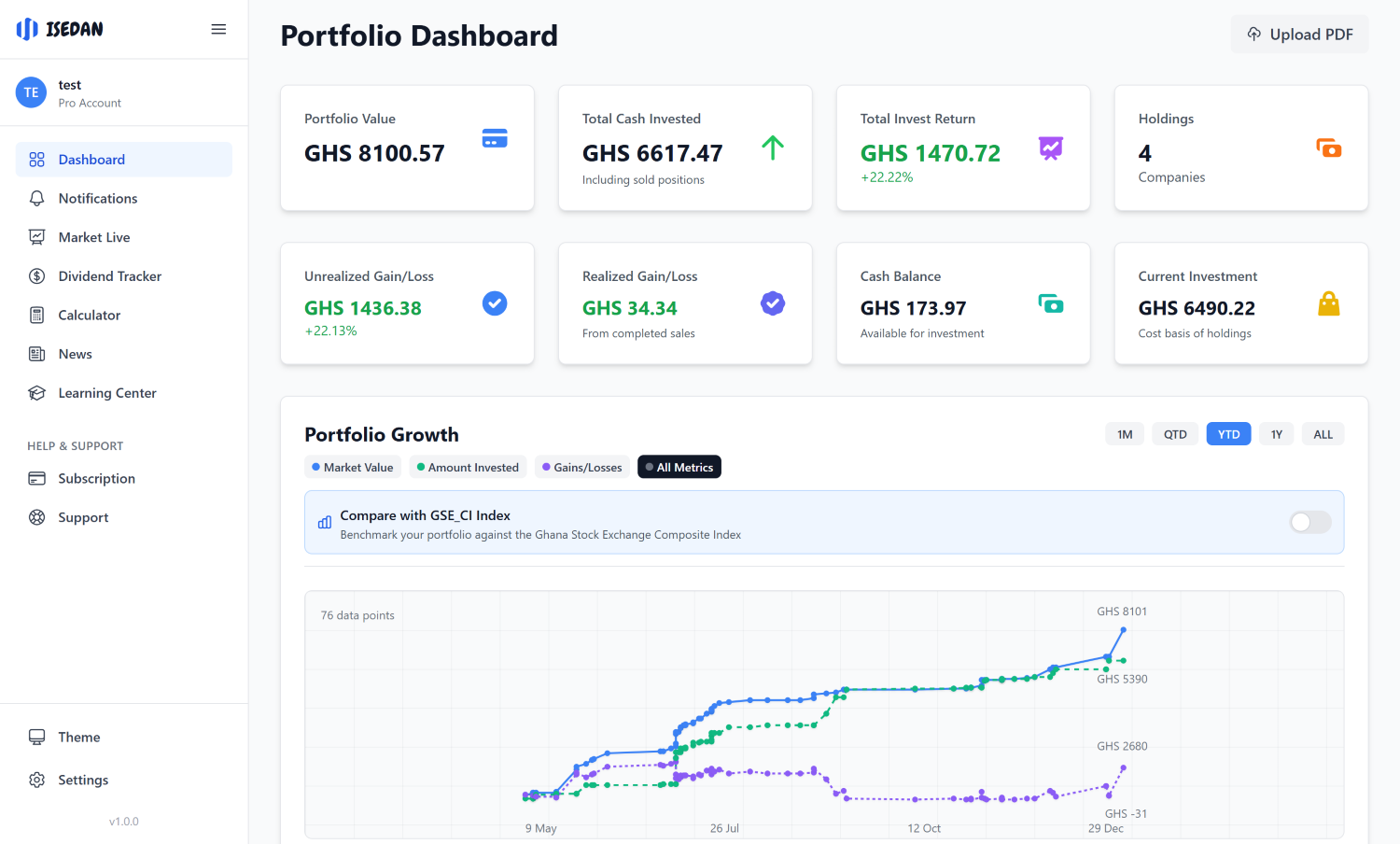

There is still much to cover in your investment journey. This is where platforms like ISEDAN come in.

![]()

ISEDAN is the leading GSE Tracker. It provides:

- Real-time GSE Data: Live stock prices, market trends, and company information throughout trading hours. This is essential in deciding when to place sell or buy orders based on market activity.

- Portfolio Analysis: Comprehensive portfolio performance breakdown of statements from supported stockbrokers.

- Dividend Tracking: Comprehensive dividend monitoring with ex-dates, payout schedules, and notifications

- Stock Price Alerts: Set target price notifications and get instant alerts when reached

- Performance Monitoring: Detailed charts, gain/loss calculations, and historical portfolio comparisons

- Market News: Curated GSE news and company announcements to stay informed

Frequently Asked Questions (FAQ)

Can I lose all my money? While stock prices can fall, it is rare to lose everything unless a company goes bankrupt. Diversification helps mitigate this risk.

How do I get my money back? You can sell your shares on the exchange through your broker during trading hours. Settlement (receiving the cash) typically takes a few days.

Is it gambling? No. Investing is buying a piece of a real business. Gambling is betting on an outcome with no underlying asset.

Long-Term Success on the GSE

Successful investing requires continuous learning, patience, and discipline. The GSE offers opportunities in growing Ghanaian companies, but remember that investing involves risk and past performance doesn’t guarantee future results.

Start with education, begin small, and gradually increase your investments as you gain experience and confidence. Consider consulting with a financial advisor for personalized guidance, and always invest only what you can afford to lose.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Always conduct your own research and consider consulting with qualified financial professionals before making investment decisions. The author is affiliated with ISEDAN. Opinions of guest authors do not constitute the opinions of this website management.