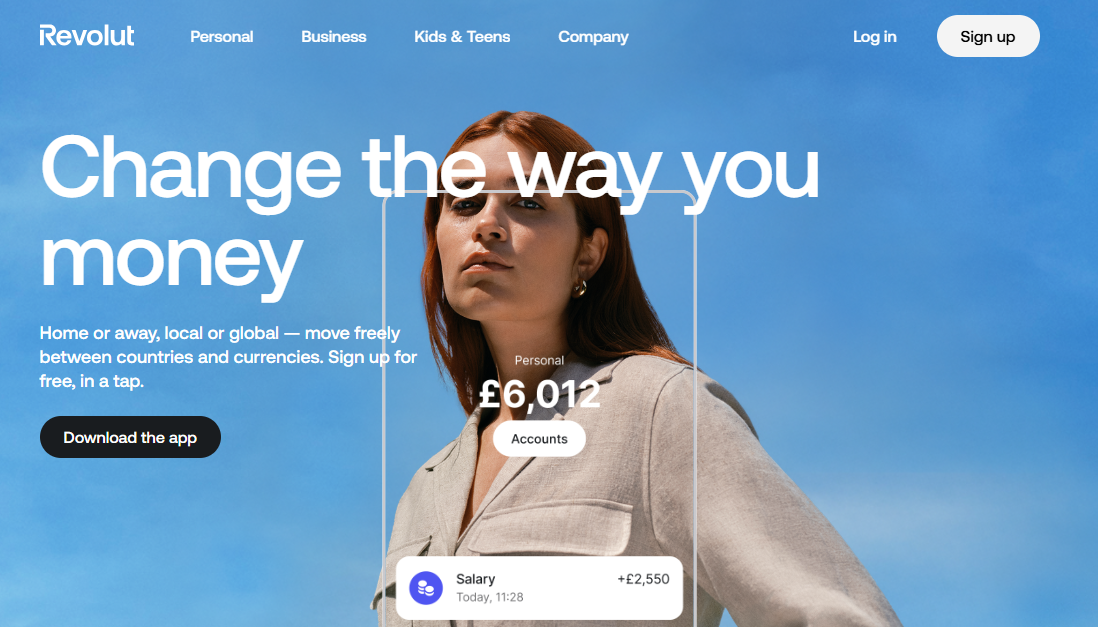

Why Can I Pay for Netflix Instantly, But Not Send Money Abroad? Enter Revolut

In my last post, I wrote about a weird paradox: paying for Netflix with a card is a seamless, one-second breeze, but sending $100 to a friend or family member across a border is a nightmare of high fees and frustrating delays.

The old systems are broken. But as I mentioned, new solutions are emerging. I want to walk you through one of the biggest names I’ve been exploring: Revolut. Is this the “super-app” that finally fixes this mess? Or is it just another walled garden?

The Core Problem: Fixing Cross-Border Transfers

The first thing you notice about Revolut is how it tackles my main complaint: cross-border transfers.

If you and I are both on Revolut, sending money is instant and free. It doesn’t matter if you’re in London and I’m in Berlin. I send it, you get it. That’s it. It feels like sending a text message. This alone is a complete game-changer.

Even if you’re not on Revolut, sending money from the app to a traditional bank account in another country is still a huge improvement. The exchange rates are fantastic (way better than a typical bank), and the fees are transparent and low.

More Than Transfers: Revolut as “Bank 2.0”

But then you look around the app and realize it’s not just a transfer tool. It’s a full-on replacement for a traditional bank, a “Bank 2.0” that lives on your phone.

I don’t just mean it’s an “app.” Revolut gives you the actual, nitty-gritty details you get from a traditional bank, like SWIFT routing details and ACH transfer details (in the US). This means you can get your salary paid directly into your Revolut account or receive transfers from any other bank, just like you would with Chase or Barclays.

It’s a bank, but with a ton of features they should have had all along.

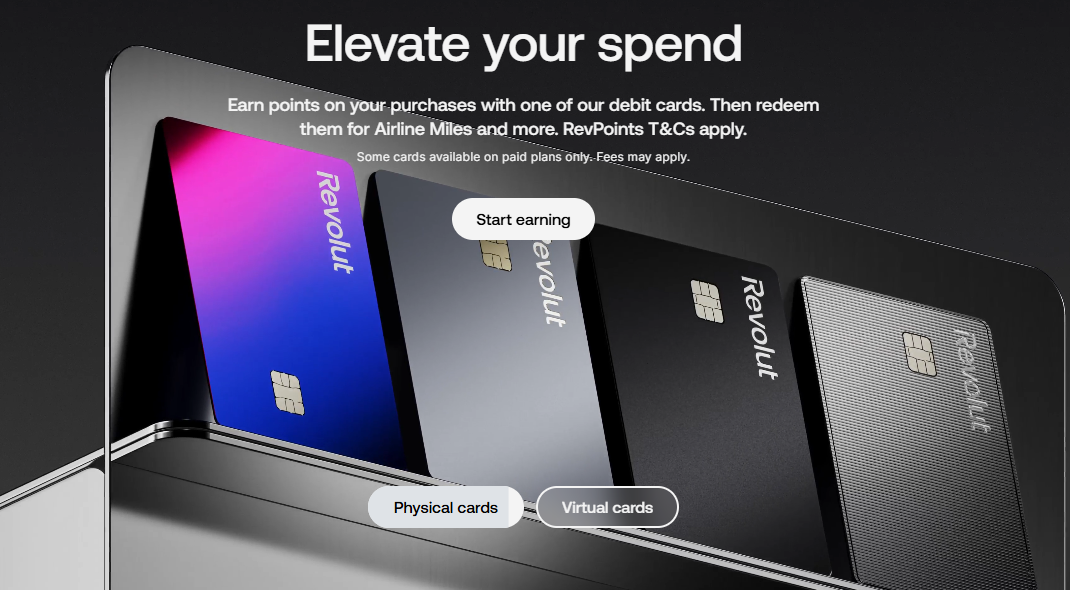

Advanced Card Control

This is one of the best parts of Revolut. It offers virtual cards (which you can create and freeze at will) for online shopping. Even better is the single-use card, which generates temporary details that are automatically destroyed after one use, making it incredibly secure for paying on unfamiliar sites.

We’ve all been there: you sign up for a free trial for a service, forget to cancel, and then get that painful “Your card has been charged” notification. And of course, these apps make it as difficult as possible to unsubscribe.

With Revolut, that problem is gone. You simply create a new virtual card for “Subscriptions,” set a monthly spending limit of, say, $15, and use it to sign up for Netflix, Apple TV, etc. You are now guaranteed to never be overcharged. This proactive control is a stark contrast to the old model, where you just get a painful notification after the money is gone.

Key Integrations

Revolut doesn’t try to lock you into its own world. The cards (both physical and virtual) work seamlessly with other major payment platforms you already use, like PayPal, Google Pay, and Apple Pay, making your online and in-store payments even easier.

Investment Options

Right from the app, users in supported regions can buy and sell stocks, cryptocurrencies, and commodities. It’s designed to lower the barrier to entry for investing, though as I’ll mention later, this isn’t available to everyone.

Referral Program

Revolut has grown largely through word-of-mouth, powered by its referral program. Users get a unique link, and if a friend signs up, orders a card, and makes a few purchases, the original user often gets a cash reward.

How to Get Started (And Who Can’t)

This is where we hit the most important part. Who can actually get this?

The Supported Country List

First, the good news. To join, you must be a legal resident of a supported country. As of now, Revolut is primarily available in:

- The European Economic Area (EEA) - countries like Germany, France, Ireland, etc.

- The United Kingdom

- The United States

- Australia

- New Zealand

- Singapore

- Switzerland

- Japan

- Brazil

You can see the full, up-to-date list of supported countries on Revolut’s help page.

The Sign-Up Process: A Note on Residency

You can’t just be visiting a supported country. If you’re in Germany for a two-week vacation, you can’t sign up. Revolut’s eligibility rules state you must be a legal resident, and they will ask for documents to prove it, like a local ID, a residence permit, or a valid long-term visa.

From my personal conversations with other users and acquaintances, this process can sometimes take longer for non-citizens, even if they are legal residents. I’ve heard from people who, for various reasons, were unable to complete the sign-up process. Others have also reported getting an account but not having access to all features, like the investment options, while still being able to use the core transfer and card services. (These are just observations, so your mileage may vary). Hopefully, the sign-up process gets smoother for everyone by the time you read this.

The “Gap”: The Challenge of Unsupported Countries

And this brings us back to the core problem. What happens when a Revolut user in the UK wants to send money to someone in Ghana, Qatar or India?

This is where the fintech magic just… stops.

Since someone in Ghana can’t open a Revolut account, they can’t receive that instant, free peer-to-peer transfer.

The sender in the UK must default to the next best option: a traditional bank transfer, initiated from their Revolut app. And what network does that use? The same old, slow, and expensive SWIFT network. This means delays (3-5 business days) and fees (SWIFT fees, plus potential intermediary bank fees). For small, frequent transactions, this is just not a solution.

How Does Revolut Compare to the Competition?

Revolut isn’t the only player in this game. The space is heating up, and you have other excellent options, especially if you’re in the UK or Europe.

- Wise (formerly TransferWise): This is Revolut’s biggest competitor in the international space. Wise was built specifically for cross-border transfers and is obsessed with transparency. It always uses the “mid-market” exchange rate (the one you see on Google) and just adds a low, clear fee. For pure, one-off international transfers to a bank account, it’s often cheaper than Revolut, especially on weekends when Revolut adds a markup. Revolut fights back with its “all-in-one” app (investing, crypto, etc.) and free peer-to-peer transfers, which Wise doesn’t have in the same way.

- Monzo and Starling Bank: These are more like “Bank 2.0” competitors, especially in the UK. They are both fully licensed banks (meaning your money has FSCS protection in the UK) that are app-first, user-friendly, and have great budgeting tools. Their international transfer features are generally good, but often not their main focus. Monzo, for example, actually partners with Wise to handle its international payments. Starling offers its own international transfers with a small fee. They are fantastic alternatives if your main goal is a better daily banking experience in your home country, with good international options on the side.

Revolut’s main differentiator is its “super-app” ambition: it wants to be your single app for transfers, cards, budgeting, trading, and more, all with a strong multi-currency backbone.

A Brief History of the “Disruptor”

Revolut’s journey helps explain its ambition.

- Founding: It was founded in July 2015 by Nikolay Storonsky and Vlad Yatsenko.

- Headquarters: It’s a British company, founded in London at the Level39 tech accelerator.

- Major News:

- It grew incredibly fast, hitting 100,000 users in its first six months.

- After Brexit, it secured an EU banking license in Lithuania to continue serving its European customers.

- It fought a long, multi-year battle to get its UK banking license, highlighting the regulatory hurdles.

- A 2021 funding round valued the company at $33 billion, making it one of the most valuable fintech startups in the world at the time.

- Today, it serves a massive customer base, reporting over 52.5 million users at the end of 2024.

Final Thoughts

Revolut’s success isn’t just about its features; it’s about the new standard it sets. It serves as a clear, working example of what modern finance should be.

It proves that cross-border transactions don’t have to be a 5-day, high-fee nightmare.

Whether you’re in a supported country or not, this shift in expectation is a good thing. It puts pressure on traditional banks and other financial institutions to do better, to be faster, and to be more transparent. The old way is no longer the only way. For those who can access it, it’s a chance to join the financial “revolut-ion” and experience a better system firsthand.

Join the Revolut-ion

Join me and over 50 million users who love Revolut. Sign up with my link

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this post is solely the opinions of the writer who is not a licensed financial advisor or registered investment advisor.