List of Banks in Rwanda and Their Services

This guide is designed for foreigners arriving in Kigali, Rwanda, to help you navigate the banking landscape. There are more than 16 commercial and microfinance banks operating in Rwanda, with most of them having branches in Kigali. Below is a list of 5 major banks operating in Rwanda in no particular order.

- Ecobank Rwanda

- I&M Bank Rwanda

- Equity Bank Rwanda

- Bank of Kigali

- BPR Bank Rwanda (Part of Atlas Mara)

The list will be focusing on their services, account types (Rwandan Franc [RWF] and US Dollar [USD] accounts), associated fees, interest rates, and foreign exchange capabilities. Where applicable, we’ve included the banks’ operations in other countries to give you a sense of their regional presence as well as their main headquarters. This comparison aims to simplify your decision-making process when choosing a bank in Rwanda. Let’s dive into more detail per bank, included at the end is a summary table for comparison.

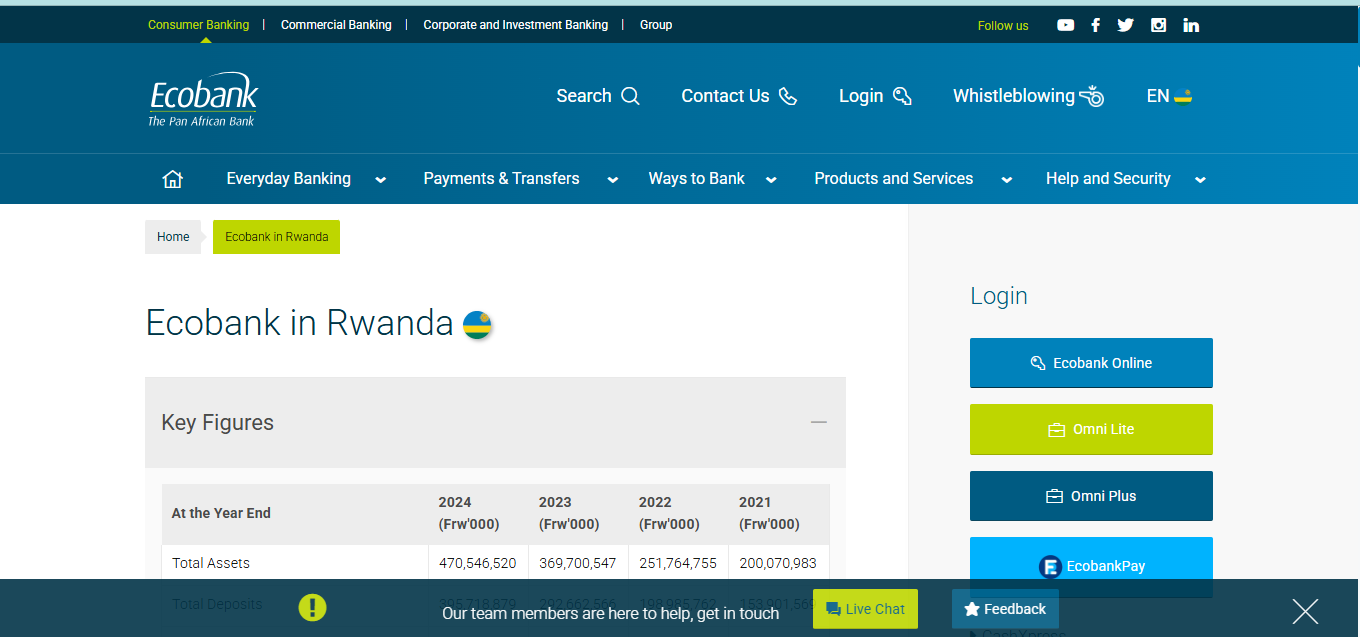

1. Ecobank Rwanda

Main Headquarters: Lomé, Togo

Operates in 36 other African countries with some subsidiaries outside the African continent.

- Account Types: Offers RWF and USD accounts.

- Fees:

- USD accounts: $20 initial deposit for non-RWF accounts, $4 monthly maintenance fee, $8 initial fee for cheque book for USD accounts withdrawals over the counter.

- USD withdrawals: 1% charge (recently introduced without prior communication from the bank).

- Cards: VISA cards provided upon request. Need separate cards for RWF and USD accounts.

- Interest Rates: No interest on USD accounts. Interest rates for RWF accounts are not publicly disclosed; contact the bank for details.

- Services:

- Foreign exchange services supporting multiple currencies (e.g., USD, EUR, GBP) via electronic transfers.

- International money transfers through SWIFT and partnerships with agents like Western Union and MoneyGram.

- Personal, business, and corporate banking products, including loans and trade finance.

- Ecobank Mobile App:

- Allows transfers to other Ecobank Rwanda account holders and to other banks in Kigali.

- Enables free transfers to other USD account holders within Ecobank’s network.

- Supports cross-border transfers to Ecobank accounts in other countries at a fee (generally cheaper than SWIFT), but both sender and recipient must be Ecobank customers; otherwise, a SWIFT transfer is required.

- Note: When converting USD to RWF via the app (for customers with both USD and RWF accounts), the exchange rate is typically less favorable than withdrawing USD and exchanging at a forex bureau in Kigali.

- Other Countries of Operation: Ecobank is a pan-African bank with a presence in 33 African countries, including Nigeria, Ghana, Kenya, Uganda, Tanzania, and South Africa.

- Notes for Foreigners: Ideal for those needing multi-currency transactions or regional transfers due to Ecobank’s extensive African network. The mobile app is convenient for local and USD transfers, but be cautious of the 1% USD withdrawal fee and less competitive app-based exchange rates for USD to RWF conversions. The USD Visa card works internationally; for instance, if buying an item on Amazon in the US costing $50, exactly $50 will be deducted when the USD card is used without additional charges.

Time to complete account creation at Ecobank Rwanda:

Approximately 3 hours to finish at the branch

2. I&M Bank Rwanda

Main Headquarters: Nairobi, Kenya

- Account Types: Offers RWF and USD accounts, as well as other foreign currency accounts (e.g., EUR, GBP, CHF, INR, JPY, ZAR, CNY, AUD, AED, CAD).

- Fees:

- USD accounts: $2 monthly maintenance fee; contact the bank for additional details. No deposit required as of 23rd May, 2025.

- Interest Rates: Offers fixed deposit accounts in RWF and foreign currencies with attractive rates, but exact rates are not disclosed; inquire directly. No interest on standard USD accounts.

- Services:

- Foreign exchange services for multiple currencies, including spot and forward transactions, and currency swaps for qualifying customers.

- BRISTK transfer service for near real-time transfers within I&M Bank’s network (Rwanda, Kenya, Tanzania) in USD, RWF, KES, and TZS.

- Diaspora banking services, including remittance management, mortgages, and personal transaction accounts.

- Loans (personal, business, mortgage) with interest rates ranging from 16–19.5% (negotiable after 1–3 months of banking).

- Other Countries of Operation: I&M Bank operates in Kenya, Tanzania, Uganda, and Mauritius (via a joint venture).

- Notes for Foreigners: A strong choice for those with regional ties in East Africa or needing diaspora services. The BRISK transfer system is a standout for fast cross-border transactions within the I&M network.

Time to complete account creation at I&M Bank Rwanda:

Less than 1 hour to finish at the branch

3. Equity Bank Rwanda

Main Headquarters: Nairobi, Kenya

- Account Types: Offers RWF and USD accounts, as well as multi-currency accounts for other major currencies (e.g., GBP, EUR, CAD, JPY, AUD).

- Fees:

- USD accounts: $15 initial deposit for non-RWF accounts. No specific monthly fees disclosed; contact the bank for clarity.

- Interest Rates: Interest offered on fixed deposit accounts, but specific rates for RWF or USD accounts are not publicly available; inquire directly.

- Services:

- Foreign exchange products for international trade and remittances.

- Consumer loans, micro-business loans, and trade finance, with loan interest rates ranging from 14–25% (eligible after 6 months of banking).

- Call deposit accounts, fixed deposit accounts, and current accounts tailored for individuals and businesses.

- Other Countries of Operation: Equity Bank Group operates in Kenya, Uganda, Tanzania, South Sudan, and the Democratic Republic of Congo.

- Notes for Foreigners: Suitable for those seeking loan products or multi-currency accounts. The bank’s regional presence is beneficial for businesses or individuals with operations across East Africa.

Time to account creation at Equity bank :

Approximately 3 hours to finish at the branch (setup accounts, connect mobile apps, mobile money services)

4. Bank of Kigali

Headquarters: Kigali, Rwanda

- Account Types: Offers RWF and USD accounts, with support for other major currencies via foreign exchange services.

- Fees:

- USD accounts: $20 initial deposit for non-RWF accounts. Specific USD account fees not listed; contact the bank for details.

- Interest Rates: Interest rates for fixed deposits are available but not publicly specified; inquire directly. No interest on standard USD accounts.

- Services:

- Foreign exchange and international money transfers via SWIFT and partnerships with agents like Western Union and MoneyGram.

- Personal and business accounts, including savings, current, and fixed deposit accounts.

- Loans (personal, mortgage, business) with competitive rates (specifics require direct inquiry).

- Other Countries of Operation: Bank of Kigali primarily operates in Rwanda, with no direct subsidiaries elsewhere, but maintains international correspondent banking relationships for global transactions.

- Notes for Foreigners: As Rwanda’s largest bank (over 30% market share), it’s a reliable option for those prioritizing stability and local presence.

5. BPR Bank Rwanda (Part of Atlas Mara)

Headquarters: Kigali, Rwanda

- Account Types: Offers RWF and USD accounts, with multi-currency support for select international currencies.

- Fees:

- USD accounts: $15 initial deposit for non-RWF accounts. Monthly fees for USD accounts not disclosed; contact the bank for details.

- Interest Rates: Fixed deposit accounts offer interest, but rates are not publicly available; inquire directly.

- Services:

- Foreign exchange services and international transfers via partnerships with Western Union and MoneyGram.

- Personal, business, and microfinance loans with interest rates ranging from 19–21%.

- Mobile banking and digital platforms for convenient account access.

- Other Countries of Operation: BPR is part of Atlas Mara, which operates in several African countries, including Zambia and Mozambique, but BPR itself is Rwanda-focused.

- Notes for Foreigners: A good option for those seeking microfinance or digital banking solutions, with a strong local presence.

Key Considerations for Foreigners

- Account Opening Requirements:

- Most banks require a passport, 1–2 passport photos, and an initial deposit (typically $3–$20 for non-RWF accounts). Some may request a work permit or 3-month bank statement from a previous bank, but this varies (e.g., Equity Bank requires 6 months of banking for loans, while I&M may require only 1 month).

- Foreign Exchange:

- Rwanda’s foreign exchange market is liberalized, allowing banks to offer multi-currency accounts and international transfers with minimal restrictions. However, exporters must repatriate earnings within three months.

- Cash vs. Digital:

- Rwanda, especially outside Kigali, is largely a cash-based or mobile money economy. ATMs are available but less widespread than in Western countries.

- Recent Updates:

- Be aware of unannounced changes, such as Ecobank’s new 1% USD withdrawal fee. Always confirm fees and rates directly with the bank.

How to Choose

- For International Transfers:

- Ecobank and I&M Bank are strong choices due to their regional networks and SWIFT/BRISK capabilities. Ecobank’s app is particularly useful for free USD transfers within its network.

- For Stability:

- Bank of Kigali, with its dominant market share, is a safe bet for local reliability.

- For Digital Banking:

- BPR Bank and Equity Bank provide robust mobile banking options, while Ecobank’s app excels for intra-bank and USD transfers.

Table summary

| Bank | Headquarters | Account Types | USD Initial Deposit | USD Monthly Fee | Interest on USD Accounts | Key Services | Regional Presence | Notes for Foreigners |

|---|---|---|---|---|---|---|---|---|

| Ecobank Rwanda | Lomé, Togo | RWF, USD | $20 | $4 | None | FX (multi-currency), SWIFT/Western Union, loans, mobile app for transfers (free intra-network USD) | 33 African countries (e.g., Nigeria, Ghana, Kenya) | Ideal for multi-currency/regional transfers; watch 1% USD withdrawal fee; app FX rates unfavorable. |

| I&M Bank Rwanda | Nairobi, Kenya | RWF, USD, multi-FC (EUR, GBP, etc.) | None (as of May 2025) | $2 | None | FX (spot/forward/swaps), BRISK transfers (East Africa), diaspora services, loans (16–19.5%) | Kenya, Tanzania, Uganda, Mauritius | Strong for East Africa ties/diaspora; BRISK for fast cross-border. |

| Equity Bank Rwanda | Nairobi, Kenya | RWF, USD, multi-currency (GBP, EUR, etc.) | $15 | Not disclosed | None | FX for trade/remittances, loans (14–25%), micro-business finance, deposits | Kenya, Uganda, Tanzania, South Sudan, DRC | Good for loans/multi-currency; regional ops beneficial for East Africa businesses. |

| Bank of Kigali | Kigali, Rwanda | RWF, USD, FX support for majors | $20 | Not disclosed | None | FX/SWIFT/Western Union, savings/current/fixed deposits, loans (competitive) | Primarily Rwanda; global correspondents | Reliable for stability/local focus; largest market share (>30%). |

| BPR Bank Rwanda | Kigali, Rwanda | RWF, USD, select multi-currency | $15 | Not disclosed | None | FX/Western Union, microfinance loans (19–21%), mobile/digital banking | Rwanda-focused; Atlas Mara in Zambia, Mozambique | Suited for microfinance/digital solutions; strong local presence. |

For the latest details on fees, interest rates, or specific services, visit bank branches in Kigali or check their official websites:

- Ecobank: www.ecobank.com

- I&M Bank: www.imbankgroup.com

- Equity Bank: www.equitybankgroup.com

- Bank of Kigali: www.bk.rw

- BPR Bank: Contact via the Rwanda Bankers Association or Atlas Mara.

Time to complete account creation is based on in-person visits to the branch of actual customers which may vary by branch. This list is based on available data as of May 2025 and may not cover all banks or services. Always verify with the bank before opening an account.

Disclaimer: The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. The content of this post is solely the opinions of the writer who is not a licensed financial advisor or registered investment advisor.